Views: 0 Author: Site Editor Publish Time: 2025-08-19 Origin: Site

You might wonder about the differences between CAPEX vs OPEX solar financing models and which is better for your situation. The best choice depends on your available funds, comfort with risk, and long-term goals. Both CAPEX vs OPEX solar financing models help you reduce energy bills and benefit the environment. With solar, you typically pay upfront for equipment and installation under a CAPEX model, while OPEX models often involve ongoing payments. Incentives can help lower initial costs in either case. After installation, maintenance costs are generally low. Many solar projects save money over time, with some reducing energy expenses by as much as 38% and cutting carbon emissions annually. Both CAPEX vs OPEX solar financing models provide consistent savings and environmental benefits, but they differ in system ownership, cost responsibilities, and maintenance duties.

CAPEX means you pay all at once to own your solar system. OPEX lets you pay slowly over time, but you do not own it.

With CAPEX, you take care of repairs and get tax savings. With OPEX, the company fixes things, but you do not get tax credits.

CAPEX can help you save more money later, but you need a lot of money at first. OPEX costs less to start and gives you the same bill each month.

Pick CAPEX if you want full control and can handle risks. Pick OPEX if you want less work and easy-to-plan payments.

Talk to a solar expert to find what fits your budget, comfort with risk, and goals best.

When you compare capex and opex solar financing, you see two ways to pay for solar. Each way is different in who owns the system, how you pay, and who is responsible.

The capex solar model means you spend a lot of money at the start. You buy and set up the solar system yourself. You own the solar plant right away. You get to decide how it runs and when to fix or upgrade it. You must handle all repairs and upkeep. You can get tax savings and save money over time. With capex, you do not pay every month for the system. You only pay for regular care and running costs. This model is good if you have enough money and want to be in charge of your solar system.

The opex solar model is different. You do not pay anything at the start. A third-party company owns and runs the solar plant. You pay only for the energy you use, usually with a Power Purchase Agreement. You do not pay monthly for the system, but you pay for the electricity you use. The third-party company fixes and maintains everything. You do not need to worry about repairs or surprise costs. Most deals last from 15 to 25 years. The opex model is good if you do not want to pay a lot at first and like steady monthly bills for energy.

Tip: The biggest difference between capex and opex solar is who owns and takes care of the system. Capex means you own and control it. Opex means a service provider owns it and handles the work.

Here is a quick comparison:

| Criteria | CAPEX Model | OPEX Model |

|---|---|---|

| Ownership | Customer owns the solar plant | Third-party owns the solar plant |

| Upfront Investment | Requires large upfront capital | No upfront investment |

| Payment Structure | One-time upfront payment for system purchase | Recurring payments based on electricity used |

| Maintenance | Customer responsible for operation and maintenance | Third-party responsible for operation and maintenance |

| Risk | Customer bears performance and maintenance risks | Lower risk for customer, third-party manages risks |

| Contract Duration | No fixed contract, ownership is indefinite | Fixed-term contracts (typically 15-25 years) |

| Financial Benefits | Eligible for tax depreciation and long-term savings | No tax benefits, immediate but smaller savings |

Capex and opex solar models let you pick what fits your budget, risk, and energy needs.

The biggest difference is who owns the solar system. With capex, you own the system. You get to make all the choices. You decide when to fix or upgrade it. You are in charge of how it works. With opex, a provider owns the system. You use the energy, but the provider runs everything. You do not get to pick when to fix or upgrade it.

Here is a table that shows who owns and controls the system:

| Aspect | CAPEX Model | OPEX Model |

|---|---|---|

| Asset Ownership | You own the solar asset | Provider owns the solar asset |

| Control | You control operations and upgrades | Provider manages operations and upgrades |

| Investment | You pay upfront costs | No upfront costs for you |

| Risk | You bear performance and maintenance risks | Provider bears most risks |

| Suitability | Good for those wanting higher return on investment and full control | Good for those wanting low risk and easy energy savings |

Capex and opex have different ways to pay. With capex, you pay a lot at the start. This is your big first payment. After that, you only pay for small things like repairs. Over time, you can save money because you own the system.

Opex works another way. You do not pay at the start. You pay for the energy you use each month. This is called a Power Purchase Agreement. Your payments are the same each month, so it is easy to plan. But, you might pay more over many years than with capex.

| Payment Structure | Benefits | Disadvantages |

|---|---|---|

| CAPEX | Lower long-term cost, full ownership, eligible for tax benefits, higher return on investment | Requires large upfront capital, you handle maintenance and risk |

| OPEX | No upfront costs, predictable payments, risk handled by provider | May cost more over time, less control, dependent on provider |

Capex gives you more control and can save you money. Opex makes it easier to plan your budget and has less risk.

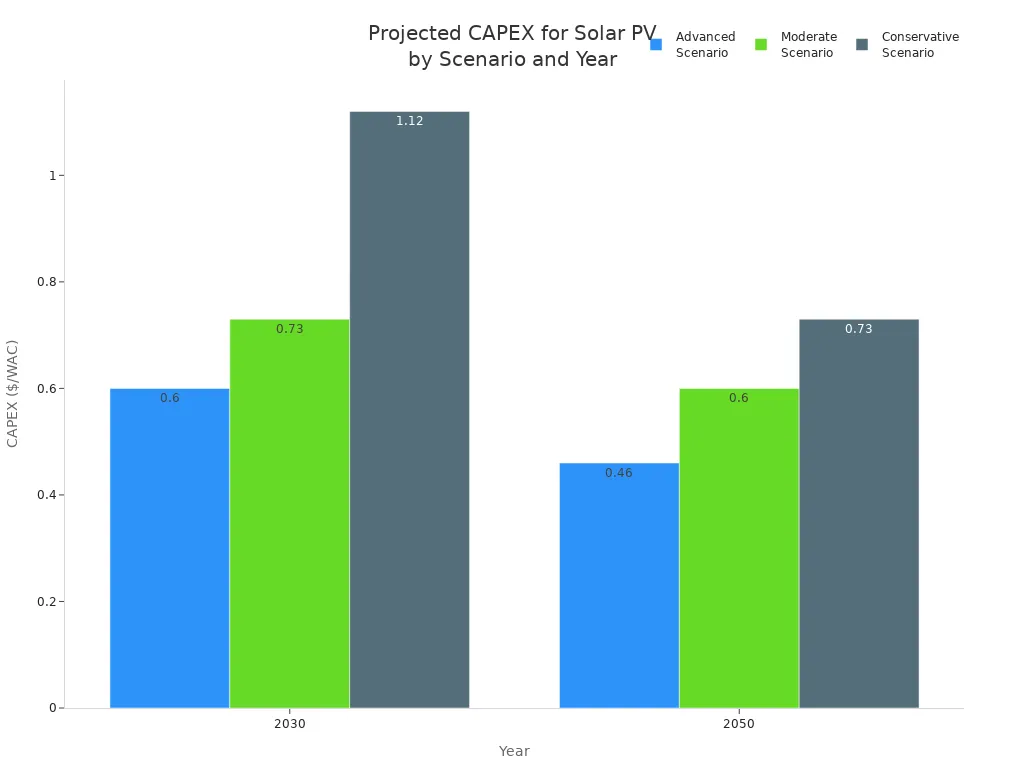

Note: Capex costs for solar may go down in the future. This could make owning a system even better for saving money.

Capex and opex have different risks with money. With capex, you take all the risks. You pay for repairs and upgrades. If something breaks, you fix it. If the system gets old, you pay to update it. You also get tax credits and rebates from the government. These can help you save more money.

With opex, the provider takes most of the risks. You do not worry about fixing things. You only pay for the energy you use. But, you usually do not get tax credits or rebates. The provider gets those instead.

In capex:

You fix and take care of the system.

You get tax credits and rebates.

You might save more money over time.

In opex:

Provider fixes and takes care of the system.

You do not pay a lot at the start.

You get steady payments but fewer rewards.

Maintenance is another big difference. With capex, you must plan and pay for all repairs. You clean, fix, and upgrade the system. Good care can help your system work better and save more money.

With opex, the provider does all the work. You do not need to hire anyone or worry about problems. This is good if you want less work.

| Maintenance Responsibility | CAPEX Model | OPEX Model |

|---|---|---|

| Who handles maintenance | You | Provider |

| Who pays for repairs | You | Provider |

| Impact on performance | Depends on your maintenance quality | Provider ensures high performance |

Tip: Taking good care of your system with capex can help you save more, but it means more work for you.

If your energy needs change, flexibility matters. With capex, you can upgrade or add more solar panels. You pay for these changes yourself. You get to choose what you want, but it can cost a lot.

With opex, the provider can make the system bigger or smaller. You do not pay a lot to change the size. This is good if you think your energy use will change.

Capex:

You pick when to upgrade or expand.

You pay for all changes.

You can make the system fit your needs.

Opex:

Provider upgrades or expands the system.

You get changes without big costs.

You have less say in the details.

Capex and opex have different contracts. With capex, there is no set contract time. You own the system for as long as you want. You must make deals for repairs and care.

With opex, you sign a long contract, often for 15 to 25 years. The provider promises the system will work well. The provider also does all the repairs. You only need to sign the energy deal.

| Contractual Element | CAPEX Model | OPEX Model |

|---|---|---|

| Performance Guarantee | You make sure the installer promises good performance | Provider promises good performance in the contract |

| Maintenance | You plan and pay for repairs | Provider does all repairs and care |

| Project Quality | You check and keep up the quality | Provider wants to do a good job |

| Management | You need to spend more time managing the project | You do not need to manage much; provider does most things |

Note: Opex contracts give you peace of mind. You get a working system and do not have to manage much.

If you pick the capex model, you own the solar system. You get to decide how it works and when to fix or upgrade it. You can save money on energy for many years. Your electricity price stays low. Many people see their home value go up after adding solar panels. You also get tax breaks and help from the government. This can help you make more money back.

Here is a table that lists the main good and bad points of the capex model:

| Aspect | Advantages | Disadvantages |

|---|---|---|

| Ownership | You own the solar system and control how it runs. | You must pay for all repairs and care for the system. |

| Financial Impact | You save money over time and get tax help from the government. | You need a lot of money at the start and may need a loan. |

| Tax Benefits | You get tax breaks and credits, which help you save more. | N/A |

| Property Value | Your property value can go up and you might get more rent or a better sale price. | N/A |

| Performance Risks | N/A | You face risks like shade, broken parts, or dirt that can lower energy made. |

| Technology Upgrades | N/A | You may need to pay more if new solar technology comes out. |

Tip: Capex is a good choice if you want full control and big savings. But you must be ready to pay more at the start and fix things yourself.

The opex model is different. You do not pay anything when you start. The developer puts in and takes care of the solar system. You only pay for the power you use. This is often cheaper than normal electricity. The developer fixes problems and keeps the system working well. They want it to work because they get paid for the energy it makes.

Here are the main good and bad points of the opex model:

You do not pay anything at the start.

Your monthly payments are lower than normal electricity bills.

The developer installs and takes care of the system.

You do not need to worry about repairs or if the system works.

But you do not own the solar system. You cannot get tax breaks or money from the government. If your contract has a floating price, your payments could go up if prices rise. You also cannot choose upgrades or changes.

| Aspect | Advantages of OPEX Model | Disadvantages of OPEX Model |

|---|---|---|

| Upfront Cost | You do not pay anything at the start. | You do not own the system. |

| Payment Structure | You pay only for the power you use, and it is often cheaper than normal electricity. | The price is set by the developer and can change or go up. |

| Risk and Maintenance | The developer takes care of repairs and keeps the system running. | You cannot control how well the system works or is fixed. |

| Tax Benefits and Subsidies | N/A | The developer gets tax breaks and help from the government, not you. |

| Breakeven Period | N/A | It can take longer to save as much money as with capex. |

| Ownership Rights | N/A | You do not own the system until the contract ends. |

Note: Opex is good if you do not want to pay a lot at the start and like steady bills. You give up some control and long-term gains for less risk and more ease.

When you look at solar financing, it helps to compare them side by side. This makes it easier to pick what works for you. The table below shows how CAPEX and OPEX solar models are different.

| Feature | CAPEX Solar Model | OPEX Solar Model |

|---|---|---|

| Investment | High upfront capital needed | Little or no upfront cost |

| Ownership | You own the solar system | Third-party owns the solar system |

| Costs | One-time payment, then low ongoing costs | Monthly or yearly payments for solar electricity |

| Risk | You take on performance and maintenance risk | Provider takes on most risks |

| Incentives | You get tax credits and property value benefits | Provider gets tax credits, not you |

| Maintenance | You handle all repairs and upkeep | Provider handles all maintenance |

| Flexibility | Less flexible, fixed system size | More flexible, can scale up or down |

| Scalability | You pay for upgrades or expansion | Provider can expand system as needed |

| Environmental Impact | Both models reduce carbon footprint | Both models reduce carbon footprint |

| Control | Full control over your solar system | Limited control, provider manages system |

| Savings Timeline | Long-term savings after payback period | Immediate savings by avoiding upfront costs |

Tip: Check these features to see which solar model fits your money, control, and future plans.

You should also think about these things before you choose CAPEX or OPEX:

Financial capacity: CAPEX is good if you have money to spend. OPEX is better if you want to save money now.

Ownership preference: CAPEX lets you own the system. OPEX gives you ease but you do not own it.

Risk tolerance: With CAPEX, you fix problems yourself. With OPEX, the provider fixes problems for you.

Long-term goals: CAPEX helps you save more over many years. OPEX gives you more freedom and less to worry about.

Market stability: OPEX often has set rates, so prices do not change much. CAPEX can have price changes over time.

Picking the right solar model depends on what is most important to you. Use this table and list to help you choose the best option for your solar needs.

Picking the best solar financing model can be tricky. You want your choice to fit your needs, money, and goals. This guide helps you look at your choices and pick what works for you.

First, check how much money you have. Some solar models need a lot of money at the start. Others let you pay over time. Look at this table to see what each option costs:

| Financial Model | Upfront Cost | Typical CAPEX/OPEX Classification | Key Features |

|---|---|---|---|

| Power Purchase Agreement | $0 upfront cost | OPEX | Fixed energy rates, no capital expense |

| Lease Options | Minimal (10-20%) | Mostly OPEX | Low upfront cost, operational expense |

| PACE Financing | 100% project funded | CAPEX | Full capital funding tied to property |

| Direct Purchase | Full system cost | CAPEX | Access to tax credits, ~15% IRR, full control |

If you have enough money or can get a loan, CAPEX models like direct purchase or PACE financing might be good. These give you ownership and help you save money later. If you want to keep your money for other things, OPEX models like Power Purchase Agreements are better for companies with less money. These let you start with little or no money up front.

Tip: Federal programs like the 30% Investment Tax Credit can help lower the cost of CAPEX solar systems.

Think about how much risk you want to take. Some people like to be in charge and fix things. Others want less work and fewer surprises. Your comfort with risk will help you choose.

CAPEX is good if you are okay with more risk. You own the system, take care of it, and get all the rewards.

OPEX is better if you want less risk. The provider owns the system, fixes it, and you just pay for the energy.

Pick CAPEX if you want control and can handle the risks. OPEX is a good pick if you want fewer surprises and want to focus on your main work.

Owning the system gives you more than just control. It also gives you extra money benefits. When you own the solar system, you can get tax credits, rebates, and even sell extra power. Here is a table to show the differences:

| Feature | CAPEX Model | OPEX Model |

|---|---|---|

| Ownership Rights | You own the solar system | Provider owns the solar system |

| Access to Incentives | You get tax credits and subsidies | Provider gets incentives, not you |

| Upfront Costs | High | Low or none |

| Ongoing Costs | Only maintenance | Monthly payments for energy |

| Lifespan Access | Full system lifespan (25+ years) | Only during contract (15-25 years) |

If you want all the rewards and to own the system, CAPEX is best. If you do not want to worry about owning or rewards, OPEX is easier.

The right solar model depends on your business and energy use. Here are some things to think about:

CAPEX is good for homes, factories, and businesses that use a lot of energy and have money to spend.

CAPEX users get ownership, tax help, and can sell extra power.

OPEX (sometimes called RESCO) is good for people who want no big payment at the start, easy bills, and no repair work.

OPEX works best for medium or big projects and for people with good credit.

Small businesses may not like OPEX if developers want bigger projects.

Note: CAPEX gives you more control and helps you save more over time. OPEX gives you more freedom and less work.

Solar energy helps you reach your green goals. Both CAPEX and OPEX lower your carbon footprint. If you want to show you care about green energy, owning the system (CAPEX) can help you report your impact. OPEX also helps the planet, but you may not control how the system is run.

Ask yourself these questions:

Do you want to own your solar system and get all the rewards?

Do you want to skip big payments and let someone else do the work?

Is your main goal to save money or to show you care about clean energy?

Picking the right model depends on your money, comfort with risk, business needs, and green goals. Take your time to think about what you need and talk to a solar expert if you want help.

Image Source: unsplash

If you are choosing between CAPEX and OPEX for solar, talking to a solar provider is smart. Solar providers know a lot about both models. They can help you pick what works best for you. Their advice will match your money, how much risk you want, and your future plans.

Before you meet a solar provider, think about what is most important to you. Here are some things you should talk about:

How much money you have for solar

How much risk and work you want to take on

If you want to own the solar system or just pay for power

Who will fix and take care of the system

How much money you hope to save over time

If you can get tax credits or help from the government

Local rules, permits, and how much sun your place gets

Ways to pay, like loans, leases, or power purchase deals

A solar provider can answer your questions and explain how each model works. You should ask things like:

Who will own and run the solar system?

What do you pay at the start and later on?

Who will fix and take care of the system?

Are there tax breaks or credits for each model?

How will each choice change your savings and cash flow?

Can the deal change if you need more energy later?

Will owning the system make your property worth more?

Here is a table to help you compare CAPEX and OPEX when you talk to a solar provider:

| Factor | CAPEX Model (Own Your Solar Assets) | OPEX Model (Zero-CAPEX Solar) |

|---|---|---|

| Upfront Investment | Requires capital investment | No upfront investment |

| Ownership | You own the solar plant | No ownership; pay for electricity |

| Financial Benefits | Maximize long-term savings | Pay-for-use tariff structure |

| Operation & Maintenance | You handle O&M | Provider handles O&M |

| Risk & Responsibility | You assume risks | Provider assumes risks |

| Property Value Impact | Increases property value | No impact on property value |

| Ideal For | Companies with capital and long-term focus | Companies wanting low risk and no CAPEX |

Tip: A solar provider can help you see which model matches your needs and goals. Their help can make sure you get the most from your solar project.

Both CAPEX and OPEX solar models give you real ways to save money and support clean energy. Your best choice depends on your budget, comfort with risk, and long-term plans. Many companies use creative financing to solve cash flow problems and speed up solar projects. You can see big savings, like Target’s $8 million each year, with the right model.

Review your resources and goals

Think about who will handle repairs

Talk to a solar expert for advice

Smart planning helps you get the most from your solar investment.

You pay upfront and own the system with CAPEX. You pay over time and do not own the system with OPEX. CAPEX gives you control. OPEX gives you less risk.

You can sometimes buy the solar system at the end of your OPEX contract. Ask your provider about this option before you sign. Not all providers offer this choice.

You handle all repairs and maintenance with CAPEX. The provider takes care of everything with OPEX. This makes OPEX easier if you do not want extra work.

You get tax credits and rebates with CAPEX. The provider gets these benefits with OPEX. You do not receive them directly in OPEX.

CAPEX usually saves you more money over many years. You avoid monthly payments and get all the savings. OPEX gives you steady bills but may cost more over time.